They trust us

Conversations already hold the answers

Most teams don’t know where to look. Lender operations handle thousands of support and collections conversations every day — but effort is spread evenly, problems repeat, and opportunities to resolve or recover are missed.PathPilot helps teams focus on the conversations that actually move outcomes.

Know Where to Act

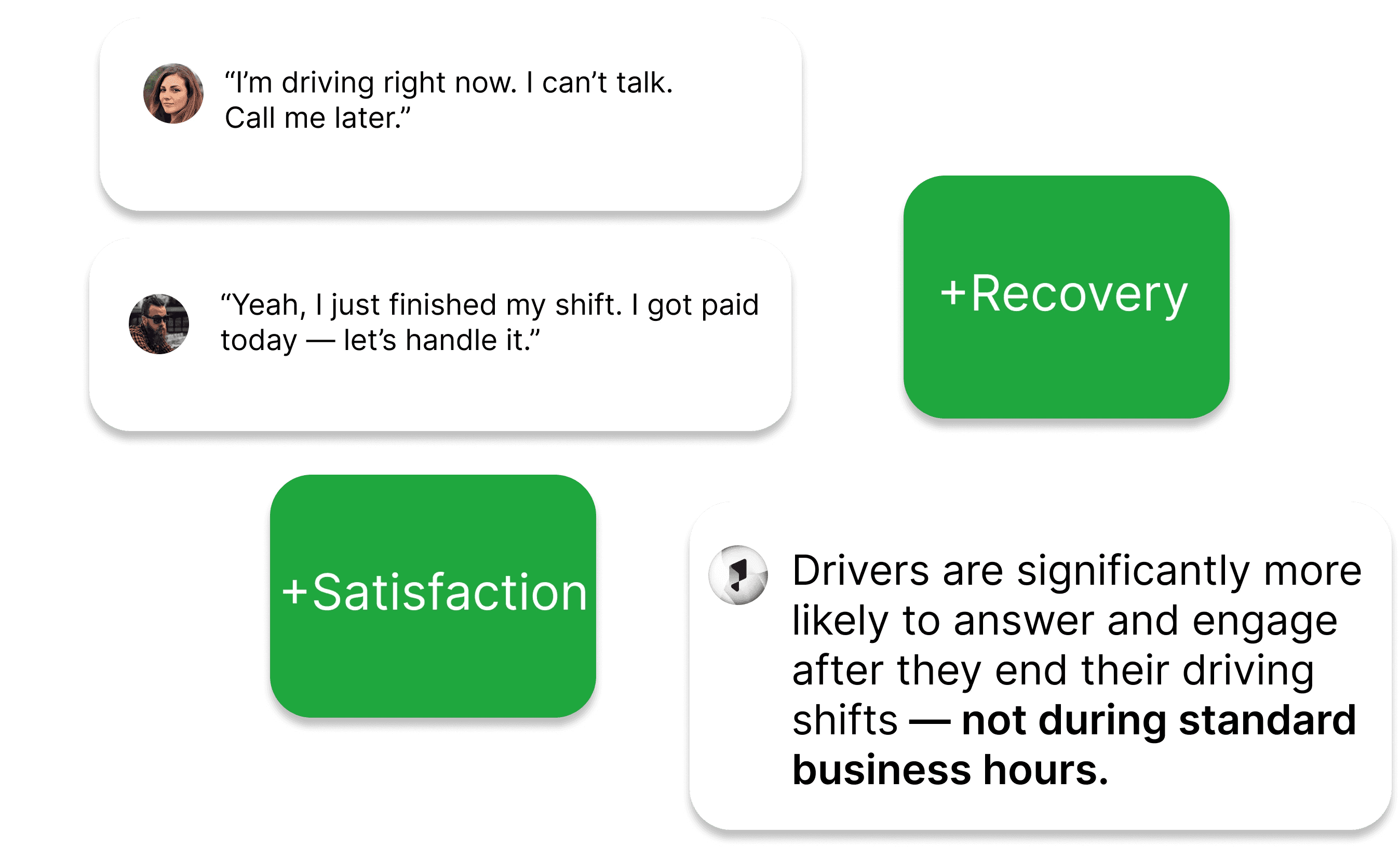

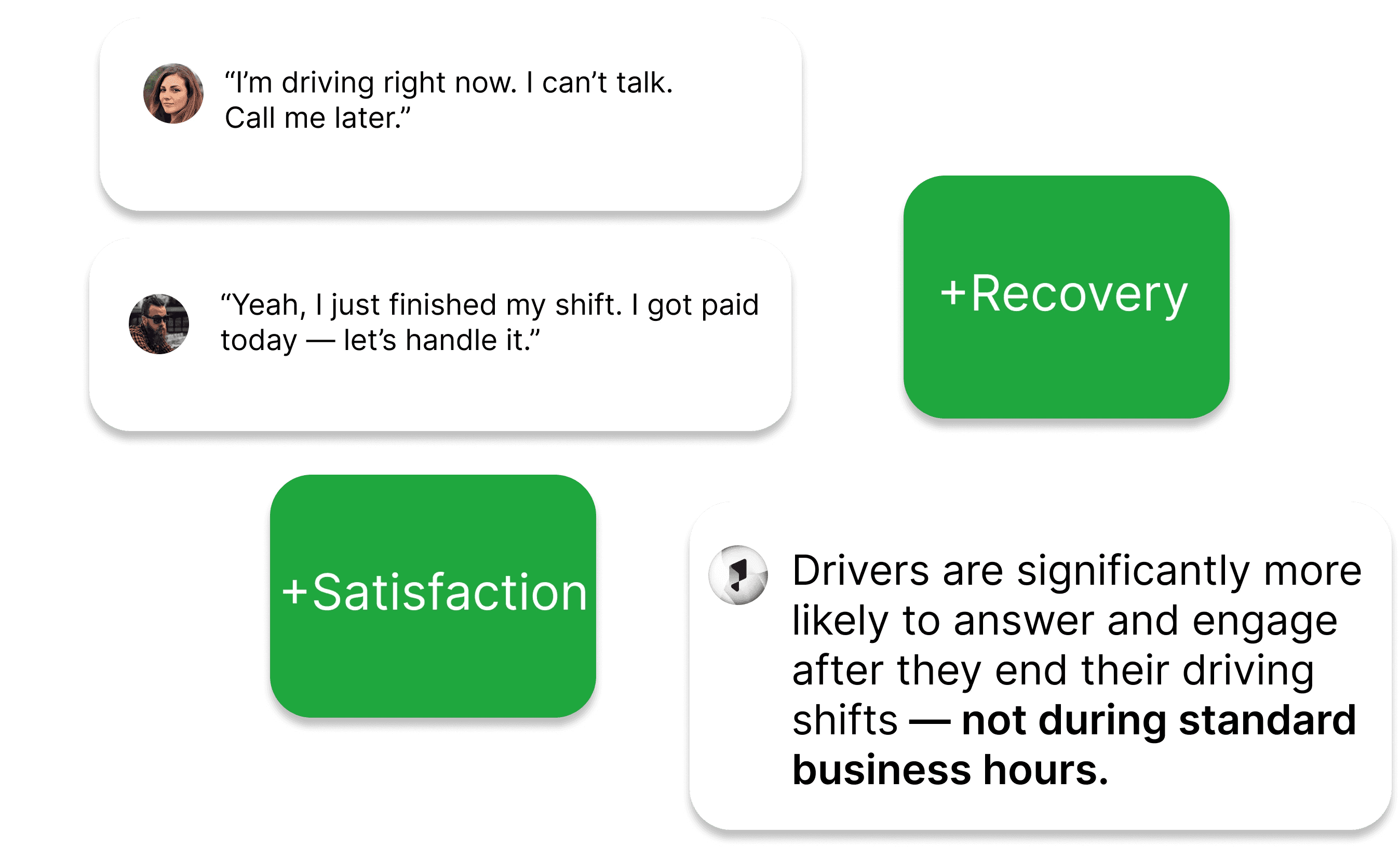

Identify the support and collections conversations that require intervention — not just review. Focus your team on cases that drive resolution, recovery, and customer satisfaction.

Reduce Cost

Increase Recovery

Control Costs

Act Earlier on Risk

Detect high-risk situations early, from frustrated borrowers to missed recovery signals. Intervene before cases escalate, repeat, or turn into lost payments.

Increase Recovery

Reduce Compliance Violations

Stop Wasting Effort

See when scripts, bots, or repeated follow-ups stop helping. Redirect human effort where it makes a difference — and disengage where it doesn’t.

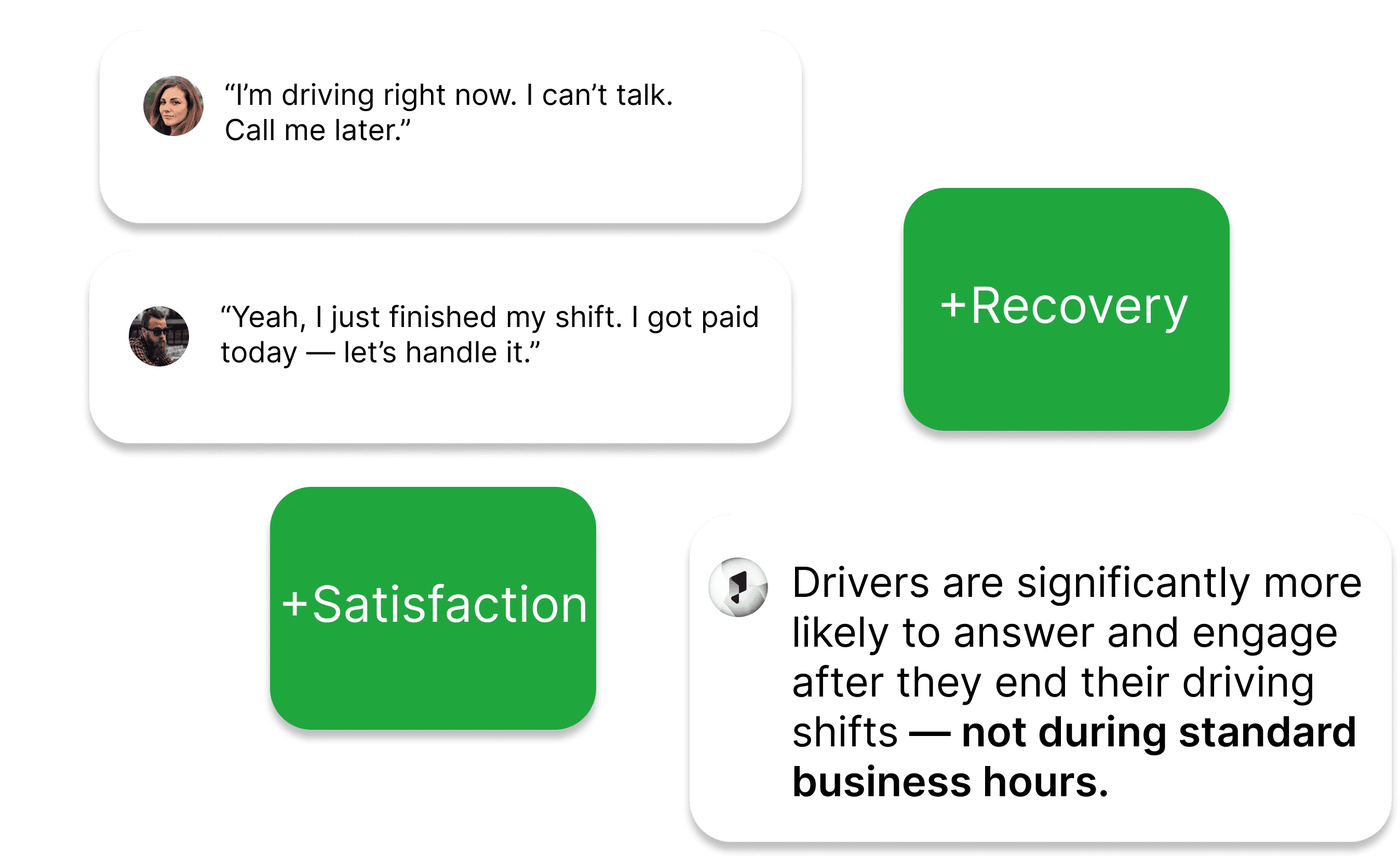

Reminders

Early-Stage Outreach

Why Fintechs Choose PathPilot

PathPilot gives fintechs a faster, safer way to operationalize AI — empowering every team to build without losing control.

Run securely — In your infra (AWS, Azure, or GCP) or PathPilot’s private cloud, with zero external data access.

Security

We keep ourselves to the highest standards

Stay compliant — Every agent action is explainable, traceable, and auditable.

Ready to scale collections efficiently?

Let PathPilot give you the control you need to scale and optimize your operations

Book demo

What people are saying

"What impressed me most about working with PathPilot was how easy it was to get our AI Agent up and running while adapting it to our specific constraints. In just days, we had a fully functional agent augmenting our contact team with real-time information, which has been key to improving our SLAs and delivering real value to our customers."

Michael Cazayoux

CEO, Sharewize

Turn Conversations into Outcomes

PathPilot helps fintech lenders turn support and collections conversations into clear actions that improve resolution, protect recovery, and reduce risk.

Book demo

They trust us

Conversations already hold the answers

Most teams don’t know where to look. Lender operations handle thousands of support and collections conversations every day — but effort is spread evenly, problems repeat, and opportunities to resolve or recover are missed.PathPilot helps teams focus on the conversations that actually move outcomes.

Know Where to Act

Identify the support and collections conversations that require intervention — not just review. Focus your team on cases that drive resolution, recovery, and customer satisfaction.

Reduce Cost

Increase Recovery

Control your AI expense

Act Earlier on Risk

Detect high-risk situations early, from frustrated borrowers to missed recovery signals. Intervene before cases escalate, repeat, or turn into lost payments.

Reduce Complaints

Timing & Jurisdiction Risk

Stop Wasting Effort

See when scripts, bots, or repeated follow-ups stop helping.

Redirect human effort where it makes a difference — and disengage where it doesn’t.

Cost efficiency

Compliance

Why Fintechs Choose PathPilot

AI without effort control creates risk and waste in collections. PathPilot gives Heads of Collections continuous visibility into cost, quality, and compliance across human agents, BPOs, and AI, so they can scale automation without losing control. Every decision is traceable, explainable, and auditable — allowing leaders to reduce cost, protect recovery, and satisfy compliance with confidence.

Run securely — In your infra (AWS, Azure, or GCP) or PathPilot’s private cloud, with zero external data access.

Security

We keep ourselves to the highest standards

Stay compliant — Every agent action is explainable, traceable, and auditable.

Ready to scale collections efficiently?

Let PathPilot give you the control you need to scale and optimize your operations

Book demo

What people are saying

"What stood out about PathPilot was the control it gave us as we scaled AI in collections. We could see exactly how interactions were performing, catch issues early, and improve efficiency without increasing risk. That visibility has been critical to protecting our SLAs and recovery as automation expanded."

Michael Cazayoux

CEO, Sharewize

Turn Conversations into Outcomes

PathPilot helps fintech lenders turn support and collections conversations into clear actions that improve resolution, protect recovery, and reduce risk.

Book demo

They trust us

Conversations already hold the answers

Most teams don’t know where to look. Lender operations handle thousands of support and collections conversations every day — but effort is spread evenly, problems repeat, and opportunities to resolve or recover are missed.PathPilot helps teams focus on the conversations that actually move outcomes.

Know Where to Act

Identify the support and collections conversations that require intervention — not just review. Focus your team on cases that drive resolution, recovery, and customer satisfaction.

Reduce Cost

Increase Recovery

Control your AI expense

Act Earlier on Risk

Detect high-risk situations early, from frustrated borrowers to missed recovery signals. Intervene before cases escalate, repeat, or turn into lost payments.

Reduce Compliance Violations

Stop Wasting Effort

See when scripts, bots, or repeated follow-ups stop helping.

Redirect human effort where it makes a difference — and disengage where it doesn’t.

Reminders

Early-Stage Outreach

Why Fintechs Choose PathPilot

AI without control creates risk in collections. PathPilot restores control by continuously monitoring human and AI interactions, enforcing quality and compliance so teams can scale automation safely and with confidence.

Run securely — In your infra (AWS, Azure, or GCP) or PathPilot’s private cloud, with zero external data access.

Security

We keep ourselves to the highest standards

Stay compliant — Every agent action is explainable, traceable, and auditable.

Ready to scale collections efficiently?

Let PathPilot give you the control you need to scale and optimize your operations

Book demo

What people are saying

"What impressed me most about working with PathPilot was how easy it was to get our AI Agent up and running while adapting it to our specific constraints. In just days, we had a fully functional agent augmenting our contact team with real-time information, which has been key to improving our SLAs and delivering real value to our customers."

Michael Cazayoux

CEO, Sharewize

Turn Conversations into Outcomes

PathPilot helps fintech lenders turn support and collections conversations into clear actions that improve resolution, protect recovery, and reduce risk.

Book demo

Turn Conversations into Outcomes

PathPilot helps fintech lenders turn support and collections conversations into clear actions that improve resolution, protect recovery, and reduce risk.

Book demo